Dedollarisation and Deglobalisation

Jakarta, 6 June 2023 – Economic dynamics never exist in a vacuum; they are always in a dialectic with their social and political context. Even so, the basic instinct remains the same, which is to optimally utilise opportunities. The same goes for dedollarisation. The fading of global economic integration is the context for the decline in US dollar asset holdings globally. Geopolitical fragmentation and the fading of globalisation underlie the dedollarisation phenomenon.

In the international finance literature, dollarisation is more broadly understood as the phenomenon of a country's economy becoming less dependent on foreign currencies, particularly the US dollar, as the dominant currency. Dependence on the dollar (dollarisation) is not necessarily bad as it indicates integration in the global economy. However, over-reliance on foreign-denominated liquidity makes the domestic economy vulnerable to volatility and monetary policy is not independent.

The recent discussion of dedollarisation refers to a global phenomenon in which many countries have begun to reduce the proportion of asset holdings denominated in US dollars by diversifying into other currencies. This phenomenon is by no means new, but the recent situation has accelerated the trend. Of course, the dominance of the US dollar will not necessarily be replaced quickly. However, it is likely that the rhythm of its decline will be faster in the future.

Geo-political fragmentation

Since Russia was ostracised by the United States, Europe, and their allies, the use of the US dollar has plummeted. As expected, the imposition of strict sanctions will trigger retaliatory policies that ultimately harm all parties. The US allies imposed harsh sanctions on Russia, including a freeze on all ruble transactions, by cutting off money exchanges between cross-border financial institutions or SWIFT (Society Worldwide Interbank Financial Telecommunication). This action marks a new phenomenon in the modern era, namely the use of currency (US dollar) as ammunition for war (dollar weaponisation).

Of course, Russia did not remain silent. Russia sells oil to India through the United Arab Emirates using dirham and ruble currencies. Meanwhile, Russia transacts various commodities, such as oil, coal, and metals with China using the yuan. Russia and its allies are rationally using this opportunity to get out of US (currency) dominance. The courage to use the yuan currency is increasingly widespread. China National Offshore Oil Corporation's (CNOOC) contract with France's TotalEnergies on natural gas exploration was first conducted in yuan last March.

Para menteri keuangan dan gubernur bank sentral negara-negara yang tergabung dalam ASEAN+3 berfoto di sela-sela acara 76th ASEAN+3 Finance Minister and Central Bank Governor's Meeting, Incheon, Korea Selatan, Selasa (2/5/2023). Salah satu kesepakatan penting dari pertemuan itu adalah komitmen untuk akan akan melakukan penyelesaian transaksi dengan mata uang lokal masing-masing negara atau local currency transaction dan tak lagi gunakan dollar AS antarnegara kawasan. (Dokumentasi Bank Indonesia)

A similar trend has been followed by many developing countries, including Indonesia, which is "bolder" in conducting transactions with local currencies (local transaction settlement). Recently, Bank Indonesia and the South Korean Central Bank agreed to encourage trade and investment transactions with their respective local currencies or do not need to be converted into US dollars. Similar agreements have been made with Malaysia, Thailand, Japan and China. The agreement with South Korea was made on the sidelines of the ASEAN+3 Finance Minister and Central Bank Governor meeting on Tuesday (2/5/2023).

The weakening role of the US dollar has not happened recently. Data from the International Monetary Fund (IMF) shows a decline in the role of the US dollar in the last 20 years. If in 2001 foreign exchange reserves in the form of US dollars still reached around 70 per cent, by the end of 2022 it had fallen to 58 per cent. Meanwhile, during the same period the yuan currency has increased its role, from nothing at all 15 years ago to 7 per cent last year.

Despite the decline, the dominance of the US dollar still remains high, especially compared to the yuan. The notion that the yuan will soon replace the US dollar is of course unfounded. However, the process of the US dollar eroding its dominance on the one hand and the yuan rising on the other may be faster than many expect. Geopolitical fragmentation has incentivised a policy of abandoning US dollar dominance in favour of other currencies.

In other words, dedollarisation is part of the symptoms of deglobalisation that have also increased since the Ukraine crisis. Deglobalisation has also been going on for a long time, but its intensity has increased recently. While globalisation will not reverse course immediately, its destination has shifted and convergence is increasingly difficult to achieve. Political-economic fragmentation will affect global civilisation in the future.

How should we respond to this changing situation? The new reality of globalisation, which is characterised by fragmentation, needs to be addressed in a clear and flexible manner. Regional collaboration needs to be consolidated intensively through the Indonesian Chairmanship of ASEAN.

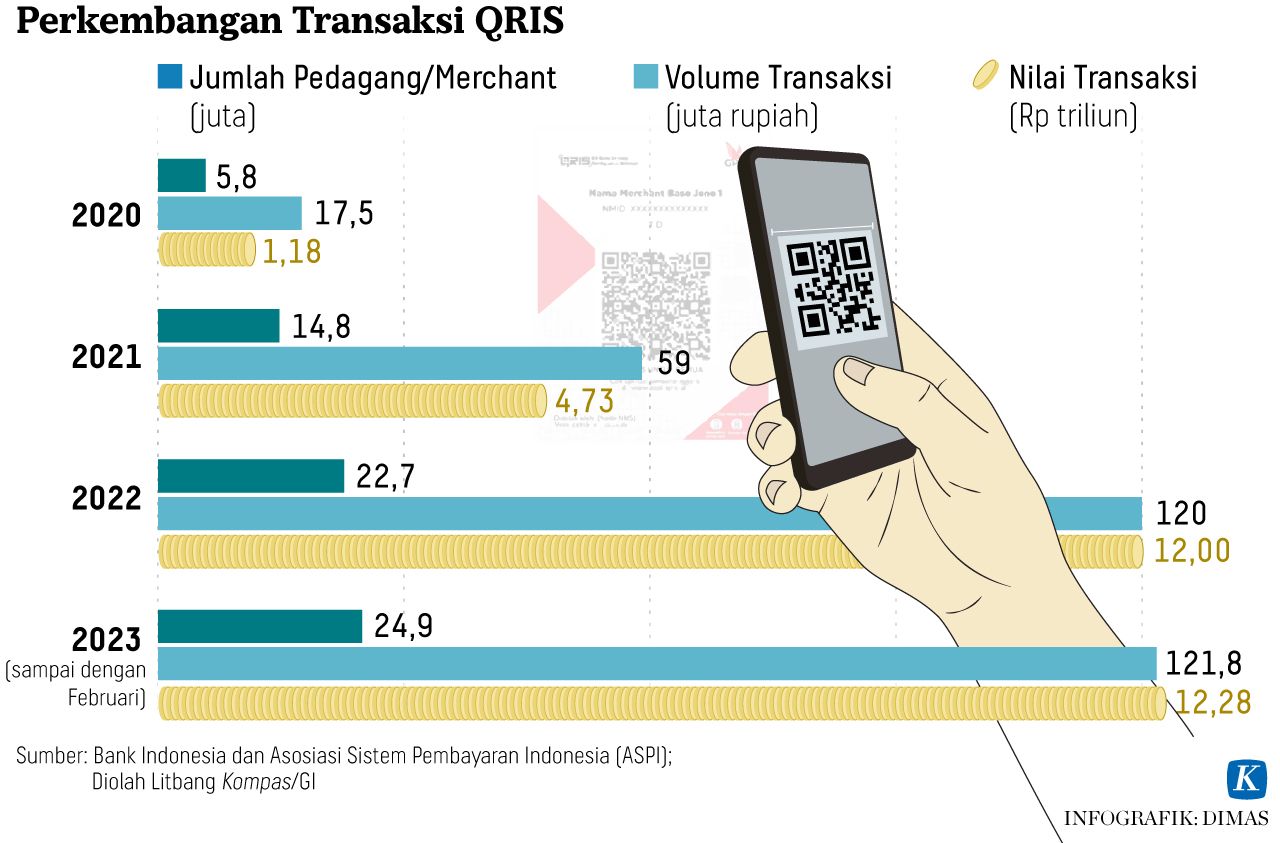

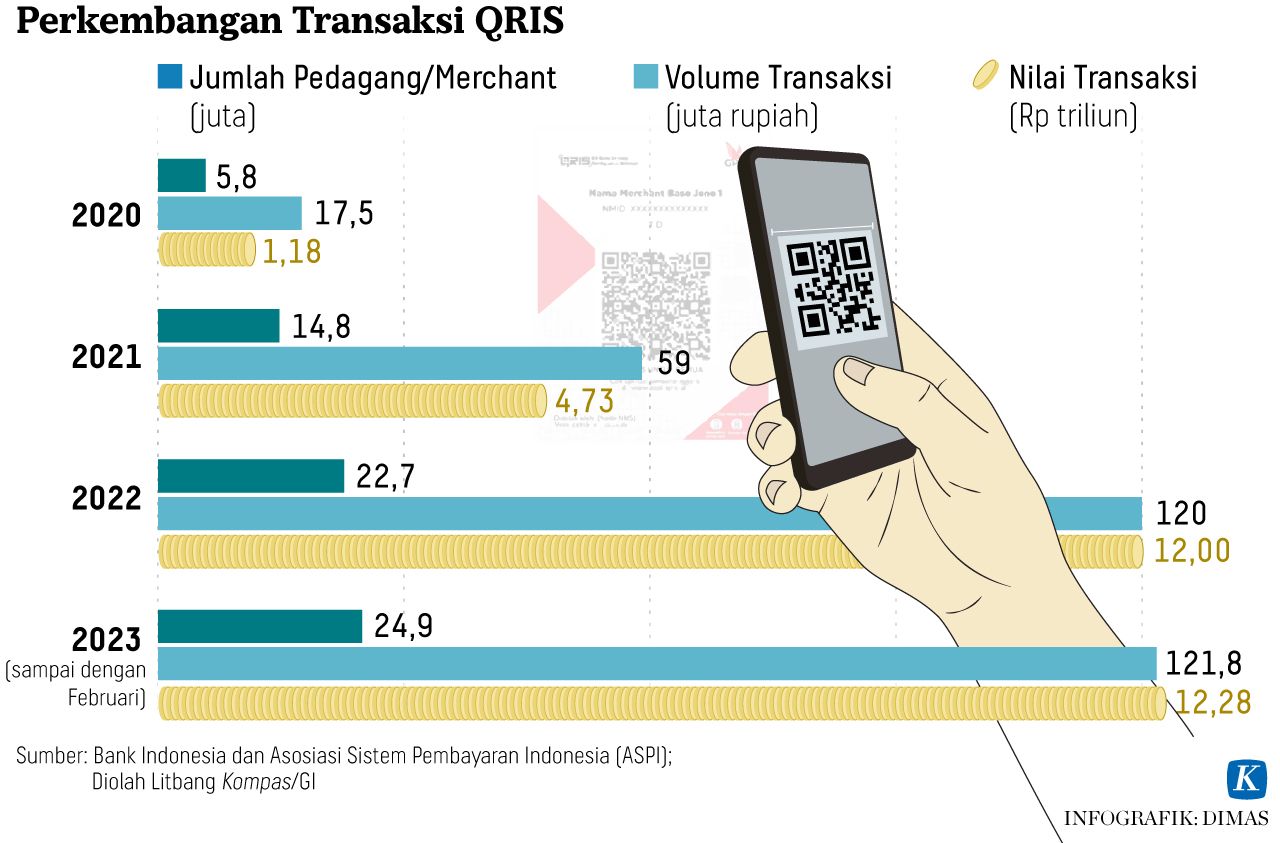

During the G-20 meeting last year, Bank Indonesia initiated cooperation in the use of digital-based payments with four other ASEAN countries (Singapore, Malaysia, Thailand, Philippines). The Quick Response Code Indonesia standard (QRIS) application supports digital payment transactions in the form of cross-border electronic money in the Regional Payment Digital Connectivity format.

Amidst the changing global constellation, the adoption of technology to support the use of local currencies needs to be expanded. Dedollarisation needs to be interpreted as an effort to strengthen regional economic ecosystems that include trade, investment and capital flows across countries. The goal is to increase domestic economic resilience through regional economic integration. This effort will not be easy as big countries continue to build new coalitions in an effort to maintain their dominance.

The steps taken by Bank Indonesia should be appreciated and supported to encourage readiness to conduct digital transactions with more and more parties. The payment system as an enabler needs to be continued with regional supply chain mapping in all aspects, from trade, investment, to industrialisation.

Asian economies could have the opportunity to grow and expand rapidly amidst increasing geopolitical fragmentation. This opportunity should be utilized to enhance domestic economic capacity.

Economic Analysis by Dr. Agustinus Prasetyantoko, Rector Atma Jaya Catholic University of Indonesia.